marin county property tax calculator

Property Tax Bill Information and Due Dates. The average sales tax rate in California is 8551.

California Public Records Public Records California Public

County of Marin Job.

. Secured property taxes are payable in two 2 installments which are due November 1 and February 1. The Marin County Assessor Supplemental Tax Estimator provides an estimate of the amount of supplemental taxes a taxpayer may anticipate. County of Marin Job.

Penalties apply if the installments are. Marin County collects on average 063 of a propertys assessed fair market value as property tax. General information on supplemental assessments and supplemental property tax bills.

Find Marin County Online Property Taxes Info From 2021. The median property tax also known as real estate tax in Marin County is 550000 per year based on a median home value of 86800000 and a median effective property tax rate of 063 of property value. Community Services Fund Program.

The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. They all are legal governing units managed by elected or appointed officers. Tax Rate Book 2016-2017.

Method to calculate Marin County sales tax in 2021. Tax Rate Book 2013-2014. Tax Rate Book 2015-2016.

An application that allows you to search for property records in the Assessors database. If you have documents to send you can fax them to the Marin County assessors office at 415-499-6542. Marin County has one of the highest median property taxes in the United States and is ranked 26th of the 3143 counties in order of median property taxes.

Property Tax Relief Assessment. Ad One Simple Search Gets You a Comprehensive Marin County Property Report. Secured property tax bills are mailed only once in October.

California Property Tax Calculator. Community Services Fund Program. Use your APN to access recent property tax bills find your outstanding balance print payment stubs or make a payment online.

Marin County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. The purpose of this Supplemental Tax Estimator is to assist the taxpayer in planning for hisher supplemental taxes while waiting for their. Taxing units include city county governments and various special districts such as public schools.

3501 Civic Center Drive Suite 208. Property Tax Estimator Will you be getting homestead. Establishing tax levies estimating property worth and then receiving the tax.

Benefits and Job Assistance. This calculator can only provide you with a rough estimate of your tax liabilities based on the property. 415 499 7215 Phone 415 499 6542 Fax The Marin County Tax Assessors Office is located in San Rafael California.

The supplemental tax bill is in addition to the annual tax bill. Martin County Property Appraiser. If you are a person with a disability and require an accommodation to participate in a County program service or activity requests may be made by calling 415 473-4381 Voice Dial 711 for CA Relay or by email at least five business days.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The median property tax on a 15070000 house is 146179 in Florida. Delinquent Court Fines and Fees.

3473 SE Willoughby Blvd Suite 101 Stuart FL 34994 772 288-5608. Property Tax Relief Assessment. In an effort to enhance public access to Assessor Parcel Maps The Marin County Assessor-Recorder in conjunction with the Marin Information Services and Technologies Department has redesigned this webpage.

San Rafael California 94903. The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year. The median property tax on a 15070000 house is 129602 in Marion County.

Tax Rate Book 2014-2015. That is nearly double the national median. Overall there are three stages to real estate taxation.

Subscribe to receive a property tax due date email notification Change Property Tax Mailing Address. Accessory Dwelling Units External Business License. The median property tax in Marin County California is 5500 per year for a home worth the median value of 868000.

You can call the Marin County Tax Assessors Office for assistance at 415-499-7215. Tax Rate Book 2012-2013. Real Property Searches.

Benefits and Job Assistance. Get driving directions to this office. All Assessor Parcel Maps have been changed from TIFF images to PDFs which should no longer interfere with your computers applications.

Remember to have your propertys Tax ID Number or Parcel Number available when you call. The median property tax on a 15070000 house is 158235 in the United States. Delinquent Court Fines and Fees.

Marin Residents Have Until Monday To Pay Property Taxes

Six Ways To Minimize Your Capital Gains Taxes When Selling Your Home Marin County Real Estate Capital Gains Tax Capital Gain Financial Literacy

Ballot Measures League Of Women Voters Marin

Marin County Home Prices Marin County Real Estate Market Overview

Marin County Now Among The Highest In Property Taxes In The Country

Marin Tax Watchdog Touts Transpartisan Approach Marin Independent Journal

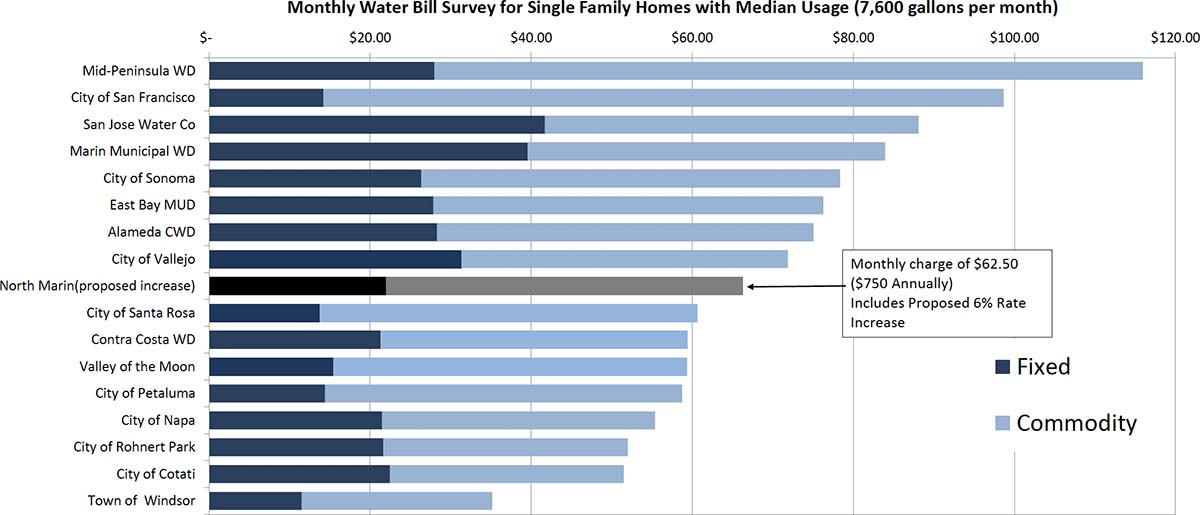

Rates North Marin Water District

This Bay Area County Is Faced With Some Of The Highest Property Taxes In The Country Abc7 San Francisco

Marin County Real Estate Market Report April 2022 Latest News

Pin By Mesina Realty Group Llc On Realtor Seller Tips Property Tax Understanding

Editorial Confusing New Law Puts Generational Family Wealth At Stake Marin Independent Journal

Marin Wildfire Prevention Authority Measure C Myparceltax

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

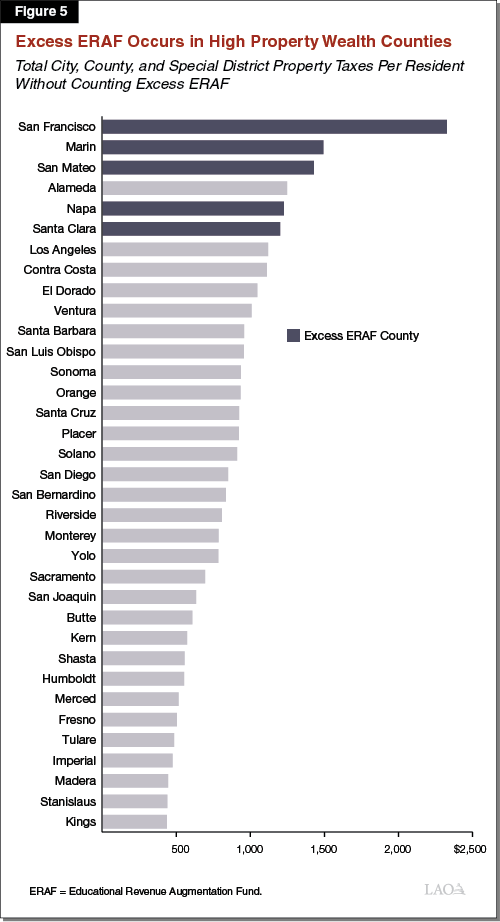

Excess Eraf A Review Of The Calculations Affecting School Funding

Marin Pilot Program Aims To Entice Landlords To Accept Section 8 Being A Landlord Entice Pilot

Transfer Tax In Marin County California Who Pays What